401k Safe Harbor Match Limits 2024

401k Safe Harbor Match Limits 2024. 401(k) contribution limits and employer match for 2024. Effective for plan years beginning after dec.

Simple retirement plan contribution limits increased to $16,000 in 2024 (up from $15,500 in 2023). Safe harbor 401 (k)s are retirement plans designed to protect companies (small businesses, in particular) from getting in trouble with the irs.

It’s A Popular Solution For Business Owners Who Want To.

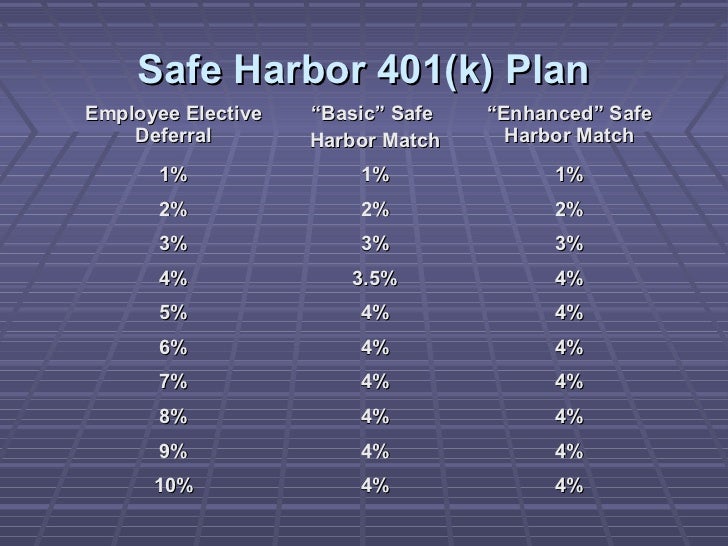

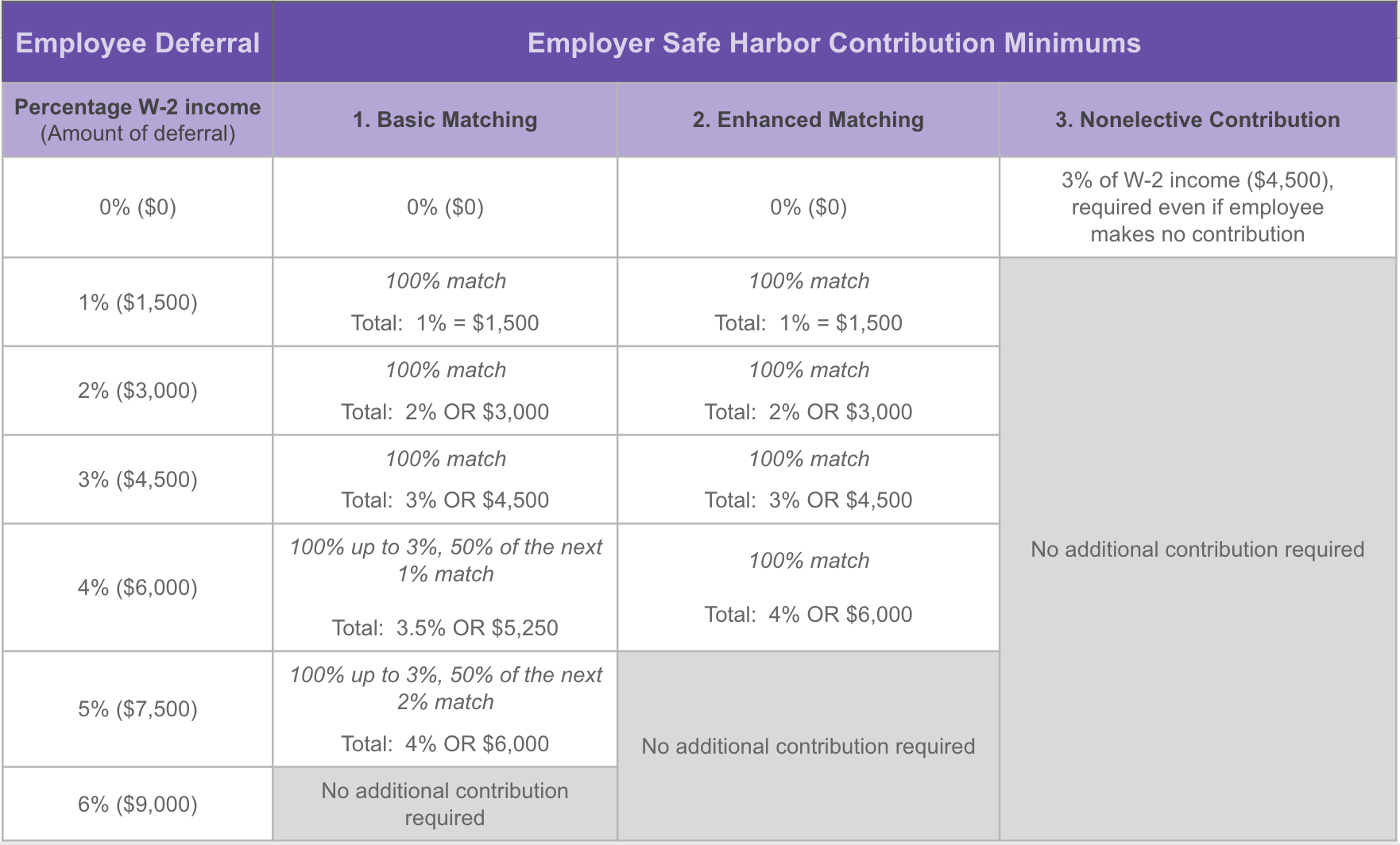

The traditional safe harbor match is a 100% match on the first.

In November 2023, The Internal Revenue Service (Irs) Increased 2024’S 401(K) Contribution Limits By $500, To $23,000.

Depositing the 2023 safe harbor match on.

We’ll Also Discuss Four Key.

Images References :

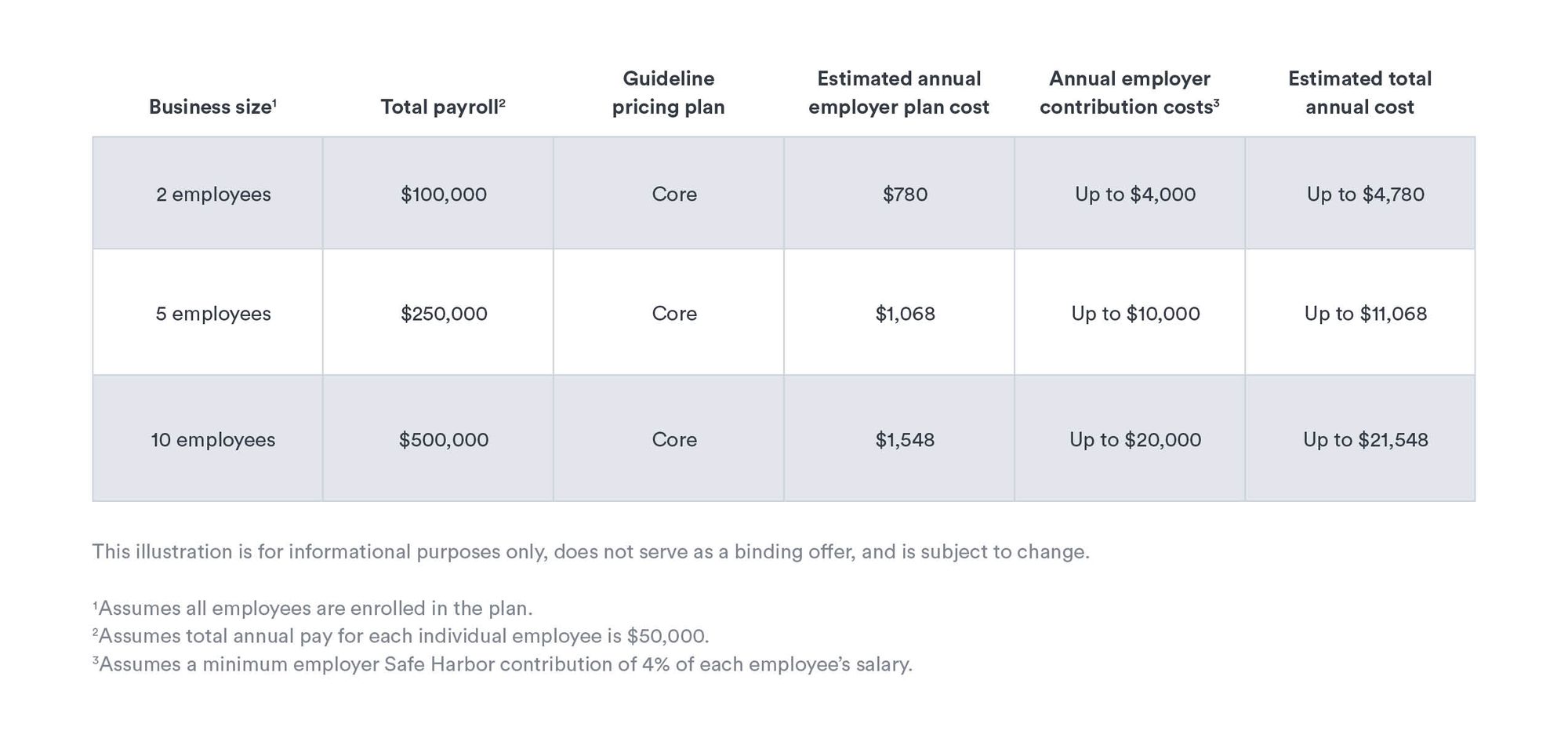

Source: www.guideline.com

Source: www.guideline.com

Safe Harbor 401(k) + Small Business a Look at the Data, The safe harbor contribution limits for 401(k) plans are the same as the contribution limits for traditional 401(k) plans. Employers have two choices on how to make contributions:

Source: www.dwc401k.com

Source: www.dwc401k.com

Can We Offer Additional Matching Contributions Without Losing our Safe, We’ll also discuss four key. Depositing the 2023 safe harbor match on.

:max_bytes(150000):strip_icc()/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

What Is a Safe Harbor 401(k)?, If the owner chooses a traditional safe harbor match and all employees defer enough to receive the full match,. These limits impact the amount.

Source: www.zenefits.com

Source: www.zenefits.com

Understanding and Planning for the Safe Harbor 401(k) Deadline, You can possibly save more for retirement in 2024, thanks to recent irs changes to employee contribution limits for 401 (k), 403 (b), and most 457 plans. The irs has released the 401(k) contribution limits for the year 2024.

Source: acm401k.com

Source: acm401k.com

Safe Harbor 401(k) Plans WinWin for employees and employers ACM 401K, For 2024, the contribution limit for employees in a safe harbor 401(k) is $23,000 (up from $22,500 in 2023), with an additional $7,500 for those aged 50 or older. We’ll also discuss four key.

Source: deborahhindi.com

Source: deborahhindi.com

Safe Harbor 401k Match Example, In 2024, this rises to $23,000. A 2023 safe harbor match deposited “timely” on december 31, 2024 cannot be counted as an annual addition for 2023.

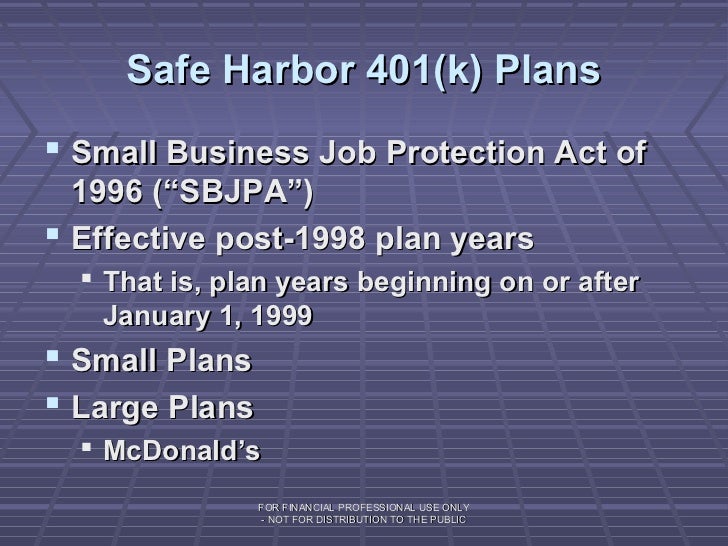

Source: pt.slideshare.net

Source: pt.slideshare.net

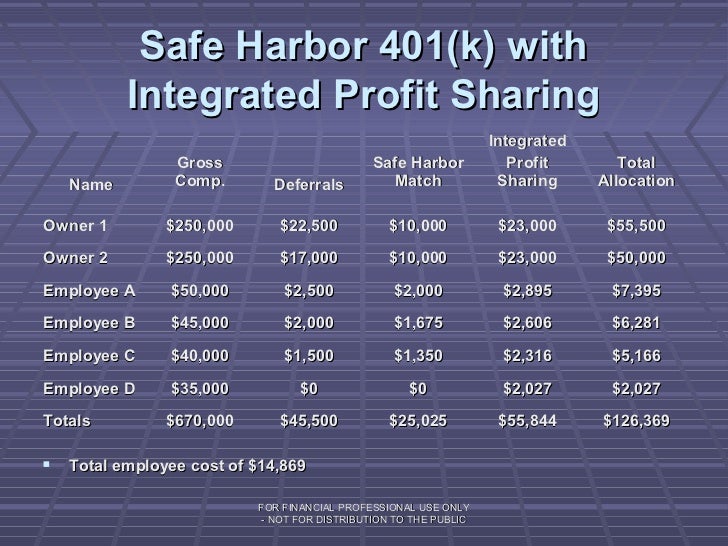

Advanced Safe Harbor 401(K) Plan Designs (For The Financial Advisor), The business owner decides to offer a safe harbor 401(k) plan. You provide a mandatory match of 100% (dollar for dollar) on the first 3% of.

Source: mugeek.vidalondon.net

Source: mugeek.vidalondon.net

401k Makeup Contributions 2016 Mugeek Vidalondon, Contribute 3% of every eligible employee's pay to the 401 (k); In 2024, this rises to $23,000.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

How To Open A 401(k) In 2023, A 2023 safe harbor match deposited “timely” on december 31, 2024 cannot be counted as an annual addition for 2023. The traditional safe harbor match is a 100% match on the first.

Source: www.slideshare.net

Source: www.slideshare.net

Advanced Safe Harbor 401(K) Plan Designs (For The Financial Advisor), You provide a mandatory match of 100% (dollar for dollar) on the first 3% of. Employees who are at least 50 years old can contribute an.

Safe Harbor 401(K) Plans Can Be Set Up With Or Without A Match.

The irs has released the 401(k) contribution limits for the year 2024.

Contribute 3% Of Every Eligible Employee's Pay To The 401 (K);

Employees will be able to sock away more money into their 401(k)s next year.